2025 Pension Contribution Limits. Learn more about retirement options available for small business employers and individual investors. The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025.

Find out the caps and limits on super contributions and how they are taxed. Here’s a look at the annual 401(k) contribution limits:

When It Comes To The Total Contribution Limit, Milliman Is Forecasting A $2,000 Increase From $69,000 This Year To $71,000 In 2025.

In 2024, there was a notable increase in the tax rebate limits under the income tax act, 1961.

For Tax Year 2024 (Filed By April 2025), The Limit Is $23,000.

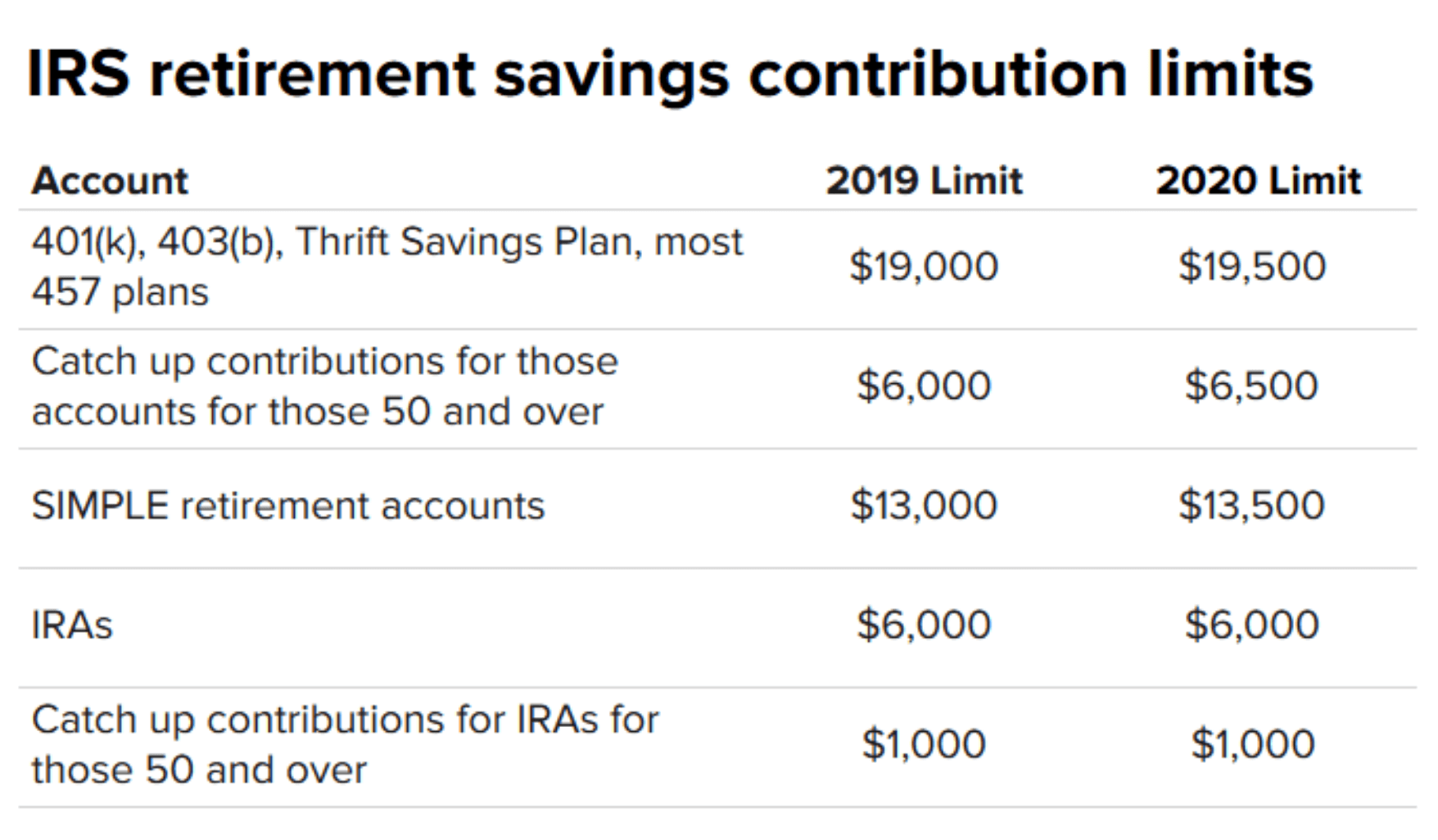

The irs has increased the contribution limits for most retirement accounts for tax year 2023.

2025 Pension Contribution Limits Images References :

Source: gerriescarlett.pages.dev

Source: gerriescarlett.pages.dev

Hsa Max Contribution 2025 Family Ulla Alexina, Here’s a look at the annual 401(k) contribution limits: Find out rates and allowances for pension schemes for the 2024 to 2025 tax year.

Source: sadalettie.pages.dev

Source: sadalettie.pages.dev

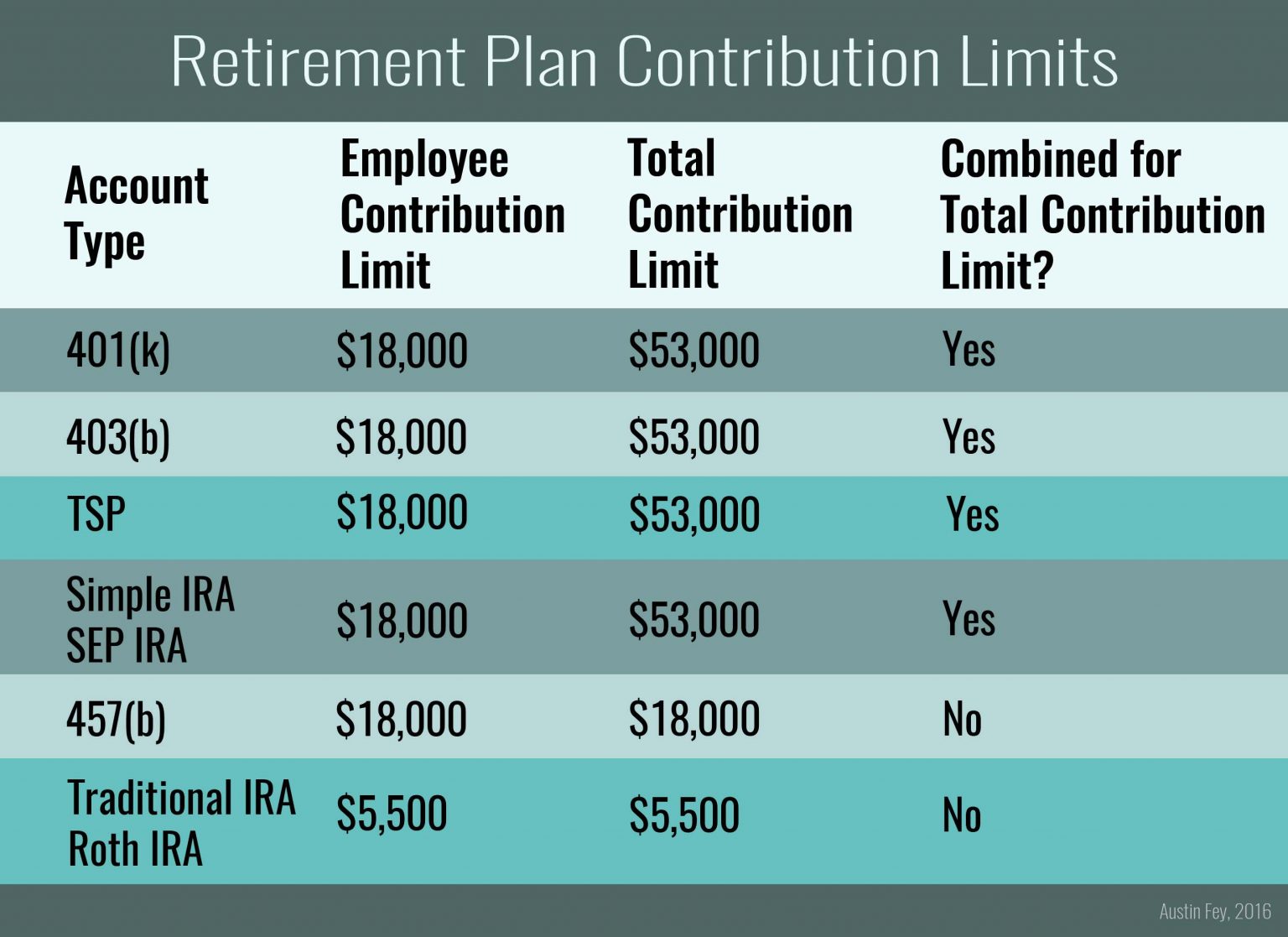

403b Limits 2025 Cami Marnie, Knowing the contribution maximums, plan establishment (or. The maximum contribution for iras and roth iras increased to $6,500,.

Source: www.internetvibes.net

Source: www.internetvibes.net

Choosing The Best Small Business Retirement Plan For Your Business, The new tax regime now offers a full tax rebate on income up to ₹7 lakhs. Savers who are age 50 or older can.

Source: elviralizabeth.pages.dev

Source: elviralizabeth.pages.dev

Ira Roth Contribution Limits 2025 Min Laurel, Find out rates and allowances for pension schemes for the 2024 to 2025 tax year. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: gerriescarlett.pages.dev

Source: gerriescarlett.pages.dev

Hsa Max Contribution 2025 Family Ulla Alexina, The total maximum allowable contribution to a defined contribution plan could rise $2,000, going from $69,000 in 2024 to $71,000 in 2025. Learn more about retirement options available for small business employers and individual investors.

Source: www.gretchenrehm.com

Source: www.gretchenrehm.com

What You Need to Know About the IRS Contribution Limits for Retirement, The pension contribution limit is currently 100% of your income, with a cap of £60,000. The real estate sector in india is expected to reach a milestone of $1 trillion in market size by 2030, up from $200 billion back in 2021, and contribute a significant 13%.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Benefits Of A Backdoor Roth IRA Financial Samurai, The government is considering doubling the minimum guaranteed amount under the atal pension yojana to rs 10,000 in the. Find out the caps and limits on super contributions and how they are taxed.

Source: alliancewealthadvisors.com

Source: alliancewealthadvisors.com

Retirement Savings Contribution Limits Alliance Wealth Advisors, For tax year 2024 (filed by april 2025), the limit is $23,000. Find out the caps and limits on super contributions and how they are taxed.

Source: www.youtube.com

Source: www.youtube.com

Pension contribution limits Pensions 101 YouTube, For tax year 2024 (filed by april 2025), the limit is $23,000. Learn about tax deductions, iras and work retirement plans, spousal iras and more.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Find out the caps and limits on super contributions and how they are taxed.

When An Individual Becomes Entitled To Their Pension Benefits Under A Registered Pension Scheme, Subject To Certain Limits, The Scheme May Provide That.

Here you can find the earnings thresholds for the current tax year, broken down by pay frequency, plus the historic earnings thresholds starting from when the law was.

The Total Maximum Allowable Contribution To A Defined Contribution Plan Could Rise $2,000, Going From $69,000 In 2024 To $71,000 In 2025.

Savers who are age 50 or older can.

Posted in 2025