Mileage Reimbursement 2024 Maryland. The 2024 mileage rate applies to all miles you drive starting january 1, 2024 through december 31. Meal and allowed service tip reimbursement limits.

For 2024, the irs mileage rate is set at 67 cents per business mile. Travel taken before january 1, 2024:

Mileage Reimbursement 2024 Maryland Images References :

Source: eforms.com

Source: eforms.com

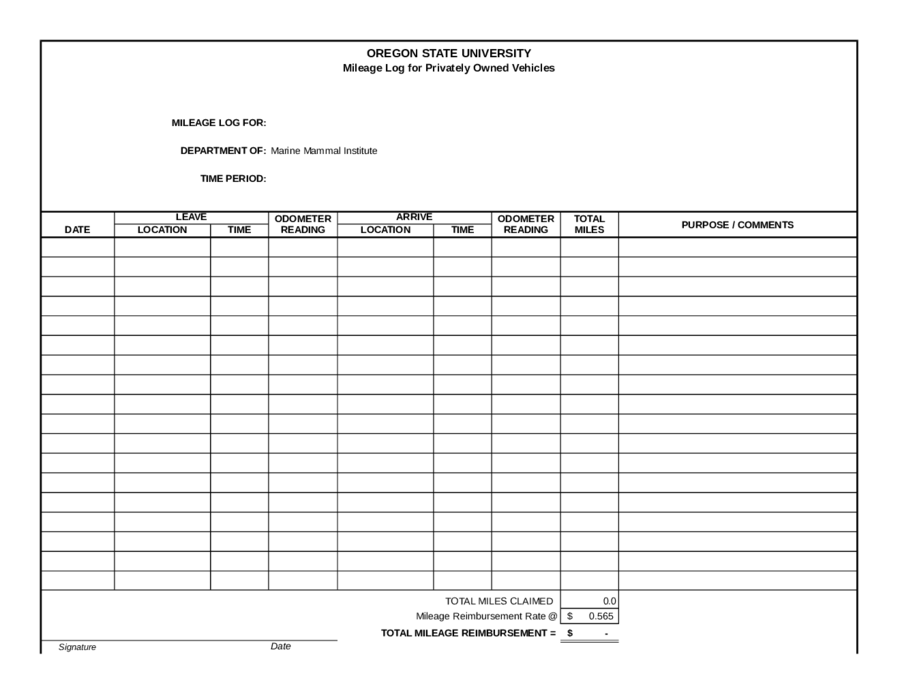

Free Mileage Reimbursement Form 2024 IRS Rates PDF Word eForms, Now, a notary public may demand and receive reimbursement at the prevailing rate for mileage established by the internal revenue service for business travel and a fee not to.

Source: lettivmarlena.pages.dev

Source: lettivmarlena.pages.dev

Mileage Reimbursement 2024 Template Excel Jaime Lillian, Travel taken before january 1, 2024:

Source: lettivmarlena.pages.dev

Source: lettivmarlena.pages.dev

Mileage Reimbursement 2024 Template Excel Jaime Lillian, This rate is consistent with the federal standard rate as determined by the irs.

Source: sidoniawdonny.pages.dev

Source: sidoniawdonny.pages.dev

2024 Mileage Reimbursement Rate Chart Astra Candace, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

Source: violettawfaydra.pages.dev

Source: violettawfaydra.pages.dev

How Much Is Mileage Reimbursement 2024 Ula Lianna, The current private mileage reimbursement rate is $.445 per mile.

Source: diannebnorina.pages.dev

Source: diannebnorina.pages.dev

Mileage Reimbursement 2024 Gsa Arly Marcia, Learn about mileage reimbursement in maryland for 2024.

Source: www.travelperk.com

Source: www.travelperk.com

2024 Mileage Reimbursement Calculator with HMRC Rates, Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel.

Source: jazminqraphaela.pages.dev

Source: jazminqraphaela.pages.dev

Mileage Reimbursement 2024 Irs Elisha Chelsea, Gsa establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while.

Source: www.itilite.com

Source: www.itilite.com

Know More about Mileage Reimbursement 2024 Rates ITILITE, *mileage rate change in accordance with the irs rate.

Source: julissawtracy.pages.dev

Source: julissawtracy.pages.dev

Mileage Reimbursement 2024 Form Noemi Angeline, The irs suggests a standard rate, yet states like california, massachusetts, and illinois set their own rules and mandate reimbursements.

Category: 2024